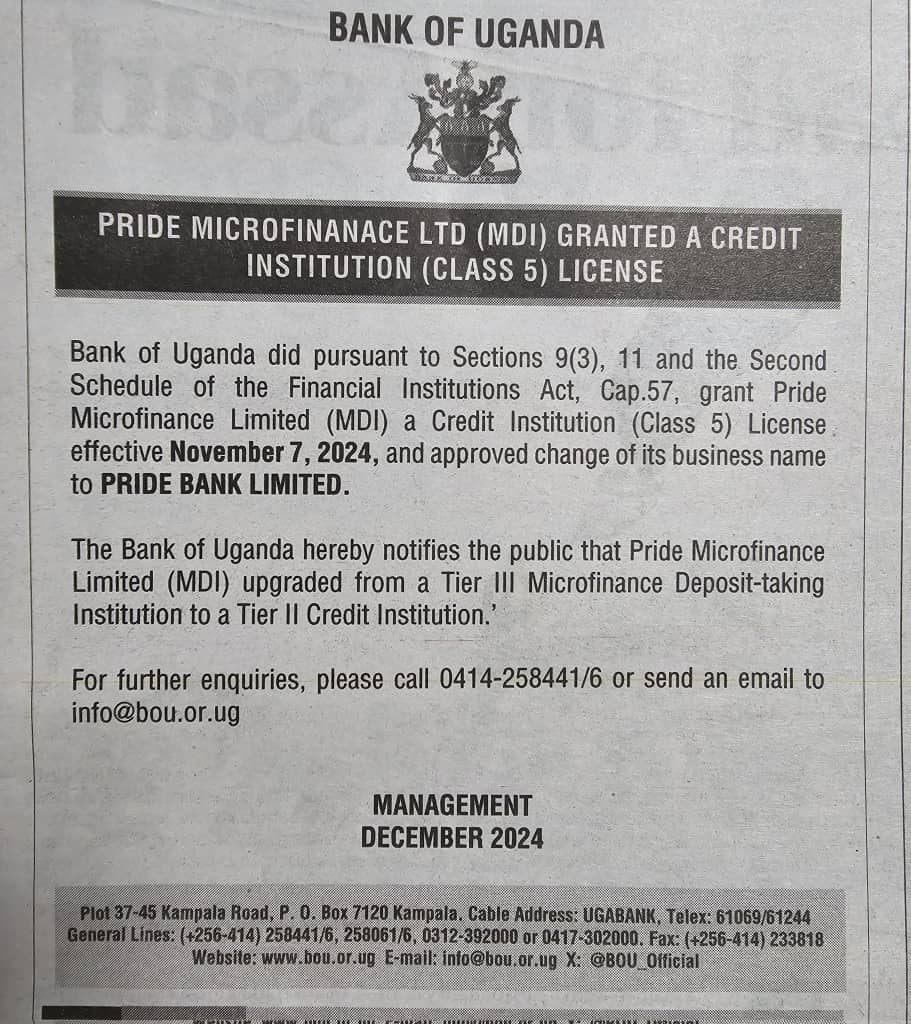

The Bank of Uganda (BoU) has officially approved the rebranding of Pride Microfinance to Pride Bank.

This development comes after the institution was granted a Credit Institution license, marking its transition from a Tier III Microfinance Deposit-taking Institution (MDI) to a Tier II Credit Institution.

In a public statement, BoU announced, “Pride Microfinance Limited (MDI) has successfully upgraded from a Tier III Microfinance Deposit-taking Institution to a Tier II Credit Institution.”

Pride Bank’s journey dates back to 1995 when it was initially established as Pride Africa, a donor-supported initiative aimed at providing financial services to low-income individuals, particularly those in agriculture.

The Norwegian Agency for Development Cooperation was among its key supporters.

In 1999, the initiative transitioned into a limited liability company under the name Pride Africa Uganda Limited. By 2001, the institution revised its Articles of Association, adopting the name Pride Uganda as an acronym for Promotion of Rural Initiatives and Development Enterprises.

Government took over operations in 2003, rebranding it as Pride Microfinance Limited. Over the years, the institution expanded its services, focusing on supporting micro, small, and medium-sized enterprises, especially in rural areas.

Pride Bank’s upgrade comes amid broader shifts in Uganda’s financial sector.

BoU has set June 30, 2024, as the deadline for financial institutions to meet new minimum capital requirements, a move aimed at strengthening the sector’s resilience.

This rebranding follows a period of challenges within the sector. Recently, Credit Institutions experienced a 21.5% drop in assets, largely attributed to the closure of Mercantile Credit Bank in mid-2024. Mercantile Credit Bank had represented over a quarter of the sector’s assets prior to its closure.

With its new status as Pride Bank, the institution aims to deepen its focus on rural entrepreneurship and financial inclusion. By providing tailored financial products to underserved communities, it seeks to drive economic growth, particularly among micro and small businesses.

Pride Bank’s evolution underscores its commitment to supporting Uganda’s rural and entrepreneurial communities while aligning with the nation’s evolving financial regulatory framework.