Parliament has passed the Public Service Pension Fund Bill, 2024 that will see public servants contribute five per cent of their salaries to the pension scheme.

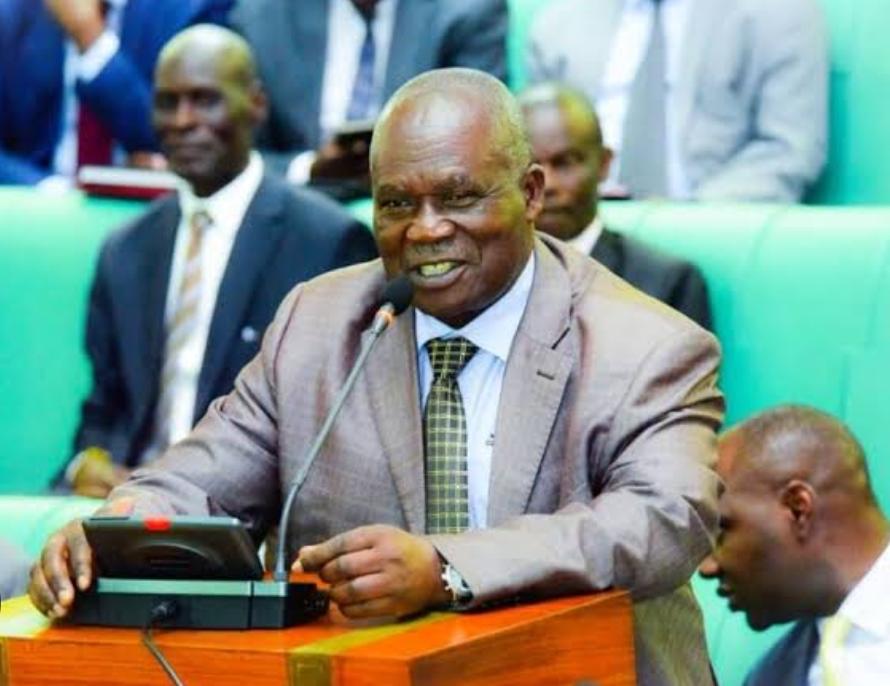

The Bill which was introduced for Second Reading by the Minister of Public Service, Hon. Muruli Mukasa on Tuesday, 25 February 2025 introduces a contributory pension scheme designed to ensure a sustainable funding source for pensioners.

According to a report on the Bill presented by the Chairperson of the Committee on Public Service and Local Governments, Hon. Ojara Mapenduzi, Uganda currently operates an unfunded, non-contributory, defined benefit pension scheme for public servants under the Pensions Act, which was enacted in 1946.

The Act grants and regulates pensions and gratuities for public service officers.

“The current system provides retirees with a lump sum upon retirement and a monthly pension based on a fraction of their last pensionable salary. However, actuarial studies have indicated the need for urgent reforms”, he said.

The committee also noted that globally, most pension schemes are transitioning to contributory systems. The Bill proposes that the public servants will contribute five per cent with government topping up with 10 per cent.

The Bill also provides for pension benefits for public servants who are dismissed from office stating that their benefits up to when they lose their jobs should be paid.

The Ministry of Public Service and other stakeholders recommended a five per cent salary enhancement across the board to offset the deductions.

“The government should prioritize salary enhancements to ensure that deductions do not adversely impact employees’ take-home pay. Additionally, salary revisions are necessary to address the low wages of public servants and the significant pay disparities across different job categories,” the committee report recommended.

The report also highlighted that the new scheme is expected to increase national savings and provide a source of affordable long-term financing, primarily for private sector investment, thereby stimulating economic growth.

Clause 8 of the Bill provides for the establishment of a Board of Trustees, appointed by the minister with Cabinet approval.

“The Board will include representatives from the Ministries of Finance, Labour, Public Service and Local Government along with public service labour unions and three technical experts from relevant fields,” the Bill proposes.

Erute South Representative, Hon. Jonathan Odurproposed that the Bill will enable the government recover dues from pensioners who default on obligations.

“To run a government effectively, citizens must fulfill their responsibilities. If you have financial obligations, such as unpaid taxes, they must be settled,” he stated.

Aringa North MP, Hon. Godfrey Onzima opposed the proposal to allow government attach the pension of an employee who has failed to pay taxes.

“The Bill is talking about contributions. When you do that, the money ceases to be yours and so government cannot take that just because I owe it taxes,” he said.

Tororo District Woman Representative, Hon. Sarah Opendi cautioned the committee against restricting the fund to only public servants saying a savings culture should be encouraged. She proposed that more citizens should be given the liberty to save with the fund.

“When we were processing the NSSF Bill, we opened it up. So rather than restrict it and then we come back to amend, we should let it be open to all,” she said.

The Attorney general, Hon. Kiryowa Kiwanuka guided that the idea for this scheme is that there should not be a public servant who is not saving.

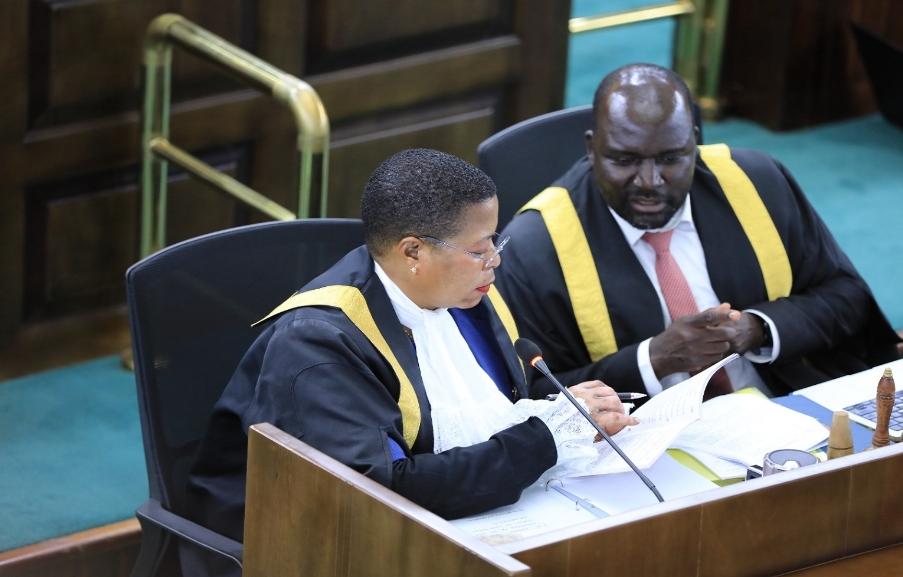

Speaker Anita Among said that persons in elective positions, members of armed forces, employees of security organisations and are public servants who are already subscribing to their own institutions do not need to be in this scheme.

According to the 2022 actuarial study, Uganda had 334,146 civil servants and 64,855 pensioners.

In the 2021/2022 financial year, the total annual pensionable emoluments amounted to Shs2.8trillion while annual pension payments totaled Shs3.1trillion.