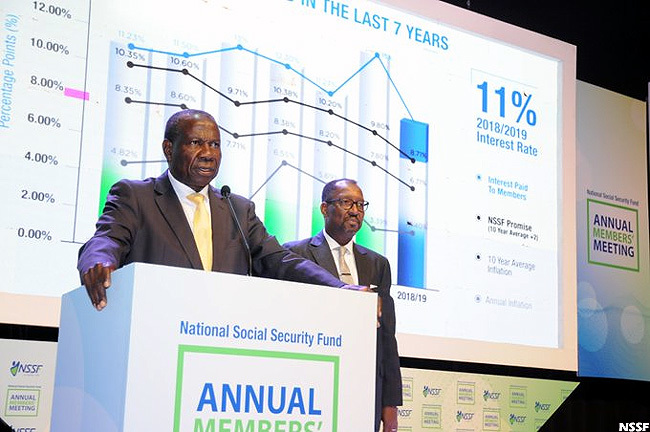

The National Social Security Fund (NSSF) has announced a 12.15 percent interest payment to its members for the Financial Year 2020/21.

The interest announcement by Finance Minister Matia Kasaija in Kampala at the NSSF member’s Annual General Meeting, reflects a strong resilience by the Fund from the effects of the coronavirus pandemic.

The minister said the current interest rate, equivalent to ShS1.52 trillion, will be credited to members’ accounts.

“In exercise of the powers conferred on me by section 35 of the NSSF Act, I hereby declare an interest rate of 12.15% to be paid as interest to the members of the fund for 2020/21. I would like to congratulate the staff at the fund for preserving the savings of the members. As I conclude please save money. Ugandans we have a bad savings culture but we need to change. Please save money,” Mr Kasaija said.

In 2019/20 NSSF paid Shs496.4 billion to qualifying members, which increased to Shs642.3 billion in 2020/21 on the back of an increase in the number of claimants and invalidity benefit paid to members affected by the coronavirus.

NSSF is the biggest investor on the local securities exchange but is also a significant equity investor on the Nairobi Securities Exchange as well as the exchanges in Dar es Salaam and Kigali. The Fund has pledged to beat the 10-year average inflation rate in its return to members, by at least two percentage points, which currently works out at about eight per cent. The Fund has paid above 10 percent over the past decade and has outperformed bank savings deposit rates and average returns on residential real estate.

Like most businesses, NSSF saw a dip in income last financial year as many companies, in which it is invested across the region, slashed or withheld dividend payments in response to the uncertainty caused by Covid-19.

In financial results released last week Managing Director Richard Byarugaba said NSSF’s income had increased by 25 percent to Shs1.8 trillion in the just-ended financial year. He attributed the bounce-back to higher returns on treasury bonds, property sales and a recovery in dividend payments by companies in which it is invested.

The results showed that NSSF grew its assets base from Shs13.3 trillion to 15.5trillion partly on the back of increased contributions from increased compliance and growing confidence. This year-on-year increase was close to the 17 percent increase in the previous reporting period reflecting the resilience of contributions and the performance of the fund. The Fund has a target to grow assets under management to Shs20 trillion by 2025.

During the financial year 2020/21, NSSF’s interest income grew from Shs1.4 trillion to Shs1.6 trillion while dividend income grew from Shs62.2b to Shs7.49b. Real estate income grew to Shs53.5b up from Shs11.1b.

NSSF commands one of the largest investment portfolios in Uganda with 78 per cent invested in fixed income while 15 percent is invested in equities and 7 percent in real estate.

After decades of underperforming, NSSF has, over the past decade-and-a-half become a key savings pot for many members, with increased interest in its performance. Reforms to allow certain forms of mid-term access and also expand the benefits and contributing pool to the Fund remain stuck after the last Parliamentary term ended without the NSSF Amendment Bill being signed off.

Role

The National Social Security Fund Uganda is mandated by the government through the NSSF Act to provide social security services to employees in the private sector.