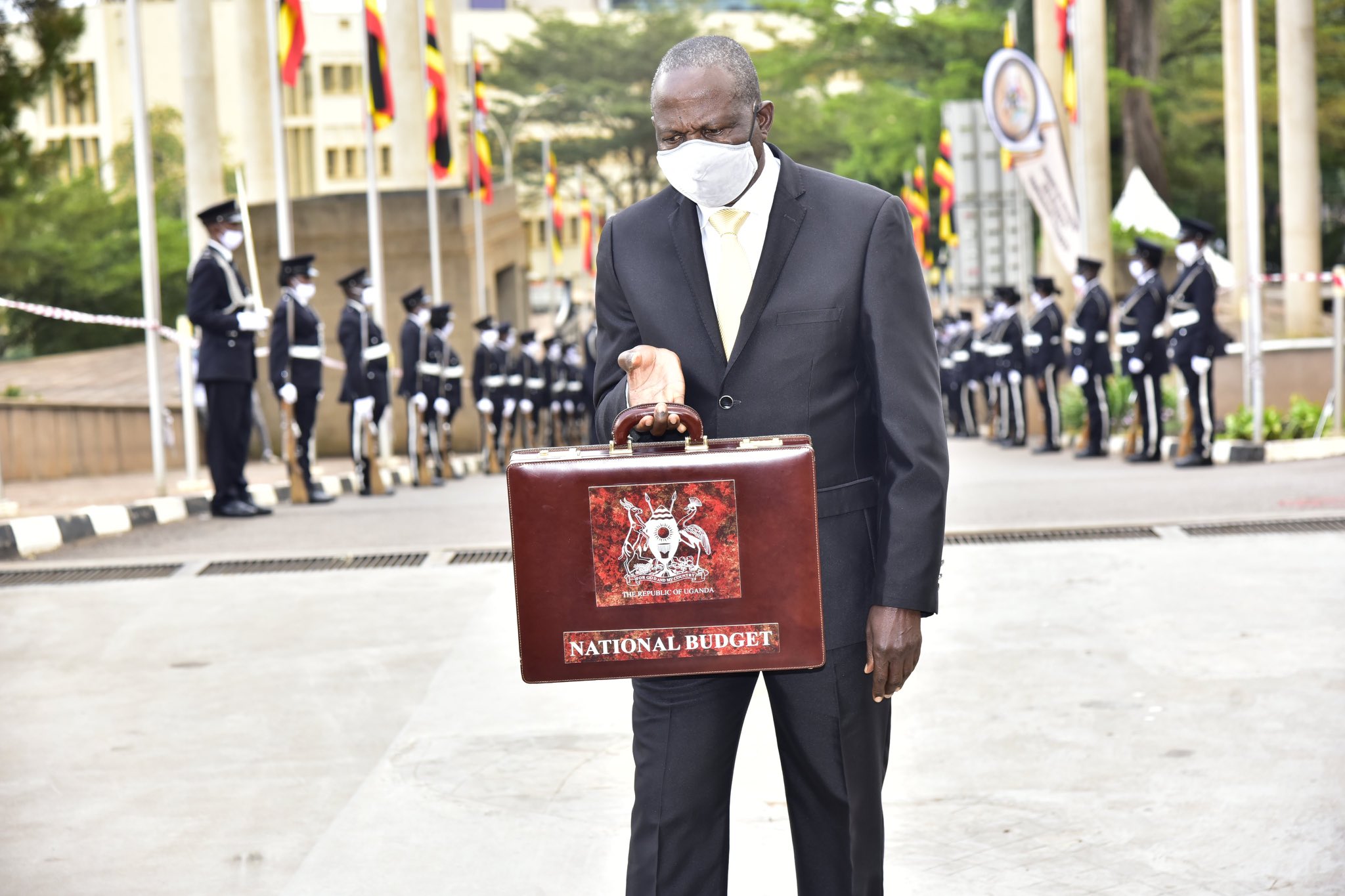

The Minister of Finance Matia Kasaija has announced the postponement of taxes worth 129.4 billion as a short term emergency relief measure to businesses affected by Coronavirus pandemic.

The taxes postponed include corporate income tax, Pay As You Earn (PAYE) and presumptive tax, which paid by smaller businesses in the informal sector.

The postponement is on until September 2020. “I am deferring until September 2020, the payment of any Corporate Income Tax and Presumptive Tax due 1st April 2020 to 30th June 2020, for tax complaint businesses with a turnover of less than Shillings 500 million per annum. Furthermore, no interest or penalties will accumulate on these amounts during this period,” said Kasaija in part.

Kasaija made the revelation during his Shillings 45.5 trillion 2020/2021 financial year Budget speech on Thursday to Parliament. The budget is under the theme ‘Stimulating the Economy to Safeguard Livelihoods, Jobs, Businesses and Industrial Recovery”.

The suspension of taxes is a huge move for businesses in the informal sector and some smaller businesses in the formal sector – many of whom are at the edge of collapse due to coronavirus measures.

Kasaija said the postponement of tax payment taxes will help boost the cash-flows for the business and ensure business continuity.

He deferred payment of corporate income tax or presumptive Tax for Corporations and Small, Medium Enterprises (SMEs).

He explained that the move is aimed to benefit companies and Small or Medium Enterprises (SMEs) especially in tourism, manufacturing, horticulture and floriculture.

The Economic Policy Research Centre (EPRC) survey found that COVID-19 pandemic and subsequent lockdown has reduced business activity by more than 50 percentage points.

The analysis showed that businesses in agriculture experienced the largest decline in business activity with 76% of the firms reporting severe decline and 12% reporting moderate decline.

The decline was according to the survey largely attributed to COVID-19 containment measures such as transport restrictions, quarantine, social distancing and ban on weekly markets, which have hindered farmers’ access to input and output markets, thus undermining their productive capacities.

It found that high percentages of businesses in manufacturing and services reported decline in ability to repay outstanding debts due to the outbreak of COVID-19 compared to those in agriculture.

According to the Minister, the number of taxpayers benefiting from this measure for whom corporate incomes tax is applicable is 10,000 companies and the deferred Corporate Income Tax is estimated to be Shillings 12.5 billion.

Meanwhile, Kasaija said the number of tax payers benefiting from the presumptive tax measure is 23,000, and the deferred tax is estimated to be Shillings 1.4 billion.

Parliament also learnt of that the deadline for payment Pay As You Earn Tax had been pushed to September 2020 from 1st April 2020 to 30th June 2020 for tax compliant Ugandan businesses facing hardships as a result of the COVID-19 pandemic.

“No interest will accumulate on tax due during this period. An estimated Shillings 65.4 billion due from Pay As You Earn (PAYE) for manufacturing and tourism sectors is being deferred. For floriculture sector, the expected PAYE deferral is Shillings 0.237 billion,” he said.

Government also waived interest and penalties on tax arrears accumulated before 1st July 2020 to lessen the tax liability of businesses who voluntarily comply with their tax obligations. Kasaija said that this tax relief as a result is Shillings 50 billion.

To further support the businesses, Kasaija announced a whopping 1.4 trillion shillings kitty that will go into Uganda Development Bank. This will be for businesses to run to and borrow at below market rates given by commercial banks. The Minister also said that government will provide for tax deduction on donations to coronavirus response task-force.

The government will also seek to quicken the payment of outstanding VAT refunds to ensure companies get back their money to carry on with their activities. A lot of companies complain of delays in refunding their VAT which leaves them with less cash for investment.

Kasaija said that the Uganda Revenue Authority (URA) will speed up payment of outstanding VAT refunds due to businesses accompanied by measures to limit fraud. Kasaija said Shillings 121 billion will be refunded.