The Deputy Speaker of Parliament, Thomas Tayebwa, has urged the Uganda Registration Services Bureau (URSB) to intensify its sensitization campaigns, particularly among Small and Medium Enterprises (SMEs), about the importance of understanding and utilizing insolvency frameworks as a safeguard against total business collapse.

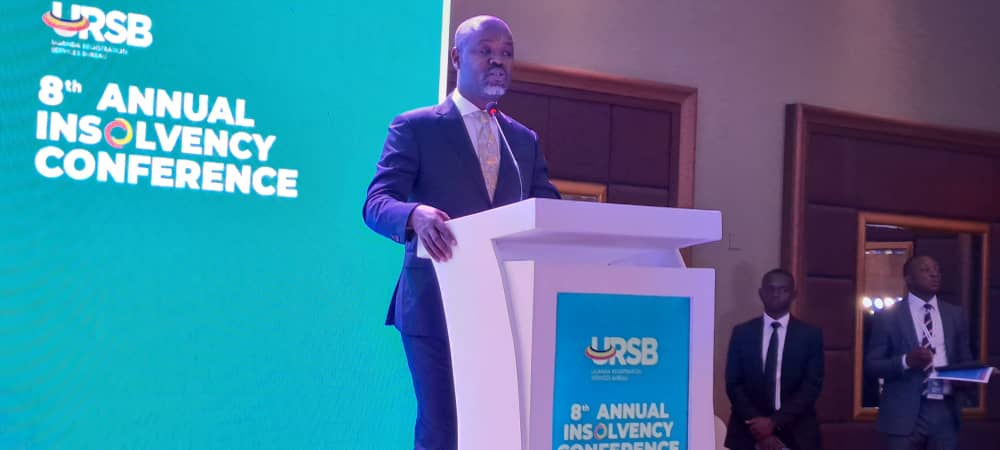

Tayebwa made the call while addressing stakeholders at the 8th Annual Insolvency Conference, organized by URSB at the Sheraton Kampala Hotel, on Thursday, 10th April 2025.

The conference held under the theme; A Resilient Insolvency Regime: Balancing Financial Stability, Recovery and Investment Strategies, aimed at strengthening capacity among legal practitioners, policymakers and entrepreneurs in managing business distress and promoting recovery through effective insolvency practices.

Describing the gathering as a timely intervention, Tayebwa praised URSB’s efforts to create awareness amidst a volatile global economy.

“This annual event is a bold step toward building confidence among the business community. Global disruptions—ranging from inflation to instability in international markets—may seem distant, but their impact is felt by many Ugandan businesses that are directly or indirectly linked to global institutions,” he said.

He warned that Uganda is not immune to the ripple effects of global downturns, noting that many businesses, especially those reliant on aid from organizations such as USAID—which contributes 40 percent of global development assistance—are now struggling.

He emphasized the need for SMEs to embrace insolvency as a second chance rather than a death sentence.

“In Uganda, the biggest barrier is not the legal framework—it is the stigma. Entrepreneurs are afraid to be seen as failures, so they hold on even when their businesses are crumbling. This mentality must change,” Tayebwa said.

He further recounted a difficult period during his business dealings in Italy when he nearly lost everything due to a misunderstanding with a partner.

“But insolvency helped restructure the business. It offered a new beginning. That’s what we need to teach our entrepreneurs—insolvency can be a tool for rebirth,” he said.

He called on URSB to deepen engagement with SMEs, particularly those operating informally.

“Many SMEs lack basic structures like bank accounts, proper records, or succession plans. When the owner dies, the business dies too. Formalization is essential if they are to benefit from legal safety nets,” he stressed.

Echoing the call to action, URSB’s Registrar General, Mercy K. Kainobwisho, revealed that the Bureau has trained over 500 business leaders under a newly launched post-crisis business rescue programme.

“Our role goes beyond registration—we help businesses navigate distress and bounce back stronger,” she said.

She noted that URSB also supports the business ecosystem through services such as intellectual property registration, collateral registry systems and verification of business documents.

“Many businesses still operate informally and are invisible to the economy. Without formal registration, they cannot be planned for or supported,” she added.

Representing the URSB Board Chairperson, H.E. Amb. Francis Butagira, Board Member Lydia Aliwonya highlighted reforms aimed at improving service delivery and ease of doing business.

“We have decentralized our services, improved non-tax revenue collection, and streamlined online registration through our ‘Chilly Easy’ mass campaign,” she said.

URSB operates under the mandate of Cap 210 of the Laws of Uganda, facilitating private sector growth and promoting a stable, inclusive investment climate through business registration and regulatory services.