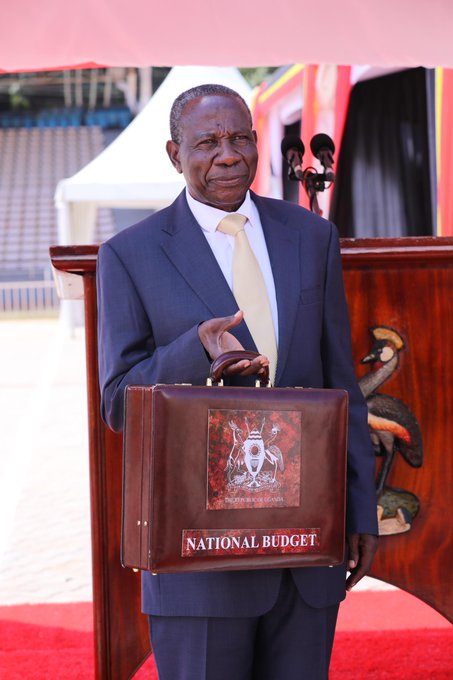

The Minister of Finance, Planning and Economic Development, Hon. Matia Kasaija, on Thursday presented a UGX 72.4 trillion national budget to Parliament for the 2025/26 financial year, outlining an ambitious fiscal strategy focused on increased domestic revenue mobilisation, efficient spending, and prudent borrowing.

Addressing the House, Minister Kasaija disclosed that the total resource envelope for the upcoming financial year stands at UGX 72,376,481,502,103. He explained that government expects to raise UGX 37.55 trillion in domestic revenue, including UGX 33.94 trillion from taxes, UGX 3.28 trillion from non-tax sources, and UGX 328.6 billion from local government collections. The budget will also be financed through UGX 11.38 trillion in domestic borrowing, UGX 10.03 trillion for refinancing maturing domestic debt, UGX 2.08 trillion from general budget support in external grants and borrowing, and UGX 11.33 trillion in external financing for projects, of which UGX 2.8 trillion is in form of grants.

The Minister stated that the fiscal strategy for FY2025/26 is anchored on strengthening tax compliance, eliminating inefficient tax waivers, and improving the effectiveness of Uganda Revenue Authority. He said the government has adopted a multifaceted financing plan that includes enhancing tax administration to generate an additional UGX 1.89 trillion, introducing new tax policy measures expected to raise UGX 538.6 billion, and rationalising tax exemptions that are not aligned with Uganda’s industrial priorities.

To bridge the funding gap, the government plans to repurpose resources from low-impact areas of the FY2024/25 budget to support the Tenfold Growth Strategy. It will also mobilise concessional loans from international development partners including the World Bank, IMF, African Development Bank, and the Islamic Development Bank, while tapping into innovative financing such as public-private partnerships, climate funds, private equity, Sukuk and Panda bonds, and diaspora bonds.

In a bid to expand the tax base without stifling entrepreneurship, Parliament approved several tax measures, including a three-year income tax holiday for citizens starting businesses after July 1, 2025, and a capital gains tax exemption for individuals formalising their businesses by incorporating companies they fully control. In a move aimed at protecting consumers from higher electricity tariffs, Bujagali Energy Limited has received an income tax waiver until June 30, 2026.

Further changes include the removal of stamp duty on mortgages and agreements, a step expected to reduce the cost of borrowing for individuals and businesses. Taxpayers who settle their principal taxes before June 30, 2026, will be exempted from interest and penalties on any outstanding amounts as of June 30, 2024. The Electronic Fiscal Receipting and Invoicing System (EFRIS) penalty structure has also been revised to ensure proportionality, replacing the flat UGX 6 million per invoice fine with a penalty equivalent to twice the tax that would have been payable.

Excise duty adjustments have been made across several categories. For example, taxes on imported soft cap cigarettes have been increased from UGX 65,000 to UGX 150,000, and for hinge lid cigarettes, from UGX 90,000 to UGX 200,000. Locally produced beer made from at least 75% local materials will now attract a UGX 900 per litre duty, up from UGX 650, while excise duty on locally made barley-based beer has been scrapped entirely.

To harmonise with East African Community customs practice, Uganda will implement a 1% import declaration fee based on the customs value of taxable goods under the Common External Tariff. An export levy of USD 10 per metric ton has been introduced on wheat bran, maize bran, and cotton cake to support domestic animal feed manufacturing. Import duties on fabrics and garments have also been revised downward to support local industry competitiveness.

According to the allocations, the government will spend UGX 8.57 trillion on wages and salaries, UGX 28.33 trillion on non-wage recurrent expenditure, UGX 18.24 trillion on development, UGX 10.03 trillion on domestic debt refinancing, UGX 4.98 trillion on debt amortization, UGX 493 billion on domestic debt repayments to Bank of Uganda, UGX 1.4 trillion to clear domestic arrears, and UGX 328.6 billion from local government own-source revenues.

Minister Kasaija concluded by stating that the approved tax measures are not solely designed to increase revenue, but also to foster a more equitable, transparent, and growth-friendly tax environment that supports economic transformation and voluntary compliance.

Among Key allocations include : Health: Shs 5.87 trillion Education: Shs 5.04 trillion Social Protection: Shs 404.9 billion Water and Sanitation: Shs 366.1 billion Wealth Creation: Shs 1.04 trillion PDM: Shs 2.118 trillion Emyooga: Shs 100 billion UDB: Shs 1 trillion UDC: Shs 187.1 billion Agricultural Credit: Shs 50 billion GROW (Women): Shs 231.3 billion INVITE: Shs 275.1 billion Skilling/Industrial Hubs: Shs 58.5 billion Microfinance: Shs 48.5 billion Agro-industrialisation: Shs 1.86 trillion Transport and Infrastructure: Shs 6.92 trillion Energy: Shs 1.04 trillion Industrial Development: Shs 308.9 billion Mineral Development: Shs 875.8 billion Science, Tech, ICT and Creative Arts: Shs 835.98 billion Tourism: Shs 430 billion (+ Shs 2.2 trillion support) Security, Law & Order: Shs 9.9 trillion Justice Administration: Shs 602.7 billion Parliament & Governance: Shs 1.03 trillion Disaster Management & Meteorology: Shs 202.1 billion