Countries take different pathways to develop. While some use domestic resources to others use foreign capital in form of foreign direct investment (FDI) or credit facility. However, even with abundant local resources, sometimes the lack of science and technological advancement, makes it hard to harness these resources. To bridge this gap, countries find themselves in such a position that they have to look outward to solicit for credit either in form of cash, expertise in technology, machinery or physical infrastructure.

Most developing economies are faced with the debate of how much credit should countries access to realize the dream of development and in which form should it be accepted? Should they accept technological transfer or develop homegrown technology that can gradually improve overtime based on the level of development? These are intriguing questions given that the development matrix is time bound due to the ever changing technology.

There have been voices critical of the intrusive nature China is providing credit to developing countries. The feeling that China is edging out historical donor countries, giving out loans without attaching them to good governance and democracy and just targeting the natural resources and flagship state assets that will pay them back without proper assessment of the impact of the recipient country. This has been termed as Debt trap diplomacy.

However, a critical analysis of what China is doing, exposes the hypocrisy of those opposed to its method. The era of technical advisors attached to donor funds is under serious threat. What China is doing is what all the western donors have done for ages, they targeted resources in form of raw materials, sent highly paid technical advisors who took back a big chunk of the donor funds in form of salaries and allowances, provided inappropriate technology that could not be maintained without them and being all knowing of what the countries wanted by dictating what to offer.

The economic boom in China has created two big challenges, it must look for resources to feed its blooming industrialization while at the same time looking for a vent for surplus finances generated by this boom. Financial institutions like Exim Bank have excess liquidity that must be invested somewhere and developing economies provide that outlay. The concessional loans are meant to make it easier for countries while at the same time relieving China of the excess liquidity.

As a strategy, China is fostering partnerships in mega projects with recipient countries. Partnerships portray them as equal shareholders while at the same time taking advantage of the resources. Partnerships foster technological transfer — that is why Chinese industries are visible everywhere.

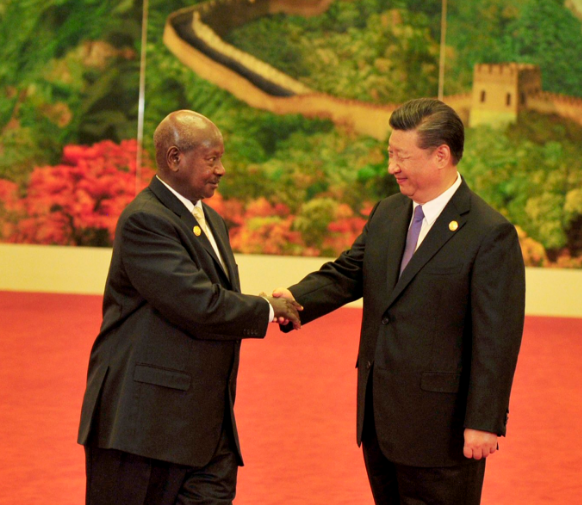

During the 2015 Forum on China-Africa summit, China announced a $60bn package for Africa and in 2018 at the same summit it announced a similar amount ($60bn) in just a space of three years. $35bn was preferential loans and export credit lines, $5bn in grants, $15bn for China-Africa development fund and $5bn for Africa small- medium enterprises (SMEs).

In response to the criticism of the debt burden situation in Africa, China has increased the package of no interest loans, grants and concessional loans to $15bn and $10bn in investment in the next three years when Chinese companies not Government will do direct investments. This is the greatest mark to signify big geo-strategic interests where China is not only seen as a lending entity but also as a business investor through Direct foreign investment.

The notion of debt trap diplomacy is mostly pushed by western countries especially the United States of America who are jittery about the rising global influence of China. The reality of the matter is that Africa’s debt to China is a small fraction of the aggregate sources of the external debt stock of Africa. However, it should be pointed out that the China debt portfolio for some countries is alarming, though most have been restructured for example Ethiopia has restructured three times its debt with China.

Those who fear a China debt trap cite the Srilankan port of Hambantota which was taken for a lease of 99 years by China due to inability to service the loan as an example. However, China argues that different situations are handled differently given the circumstances obtaining on ground, citing Venezuela the single largest Chinese debtor country where there is no takeover of flagship assets.